Six loan providers were additionally positioned under official investigation for even more serious offenses. The CFPB discovered that much of these loan providers were often targeting seniors as well as using the exact same deceptive tactics highlighted by the earlier GAO report. As defaults as well as foreclosures have raised, FHA's reverse home mortgages lowered the value of the Mutual Home Mortgage Insurance Policy Fund by $5.2 billion in Fiscal Year 2012. Requiring the Treasury Division to transfer $1.7 billion to the MMI Fund for the very first time in the Fund's history in the autumn of 2013.

After Great site twenty years, the financing balance will certainly be more than $450,000. Should the debtor pass away without having Click for info their partner on the reverse mortgage, the spouse will need to pay off the finance to remain in his or her home. As monetary stress on elders have actually raised, the varieties of reverse home mortgages have expanded, and so have the chances for unethical lenders to make use of senior citizens. These financings are complicated, expensive, and drainpipe equity from the home, leaving elders with really few options later in life. With a reverse home mortgage, the residential or commercial property stays in your name.

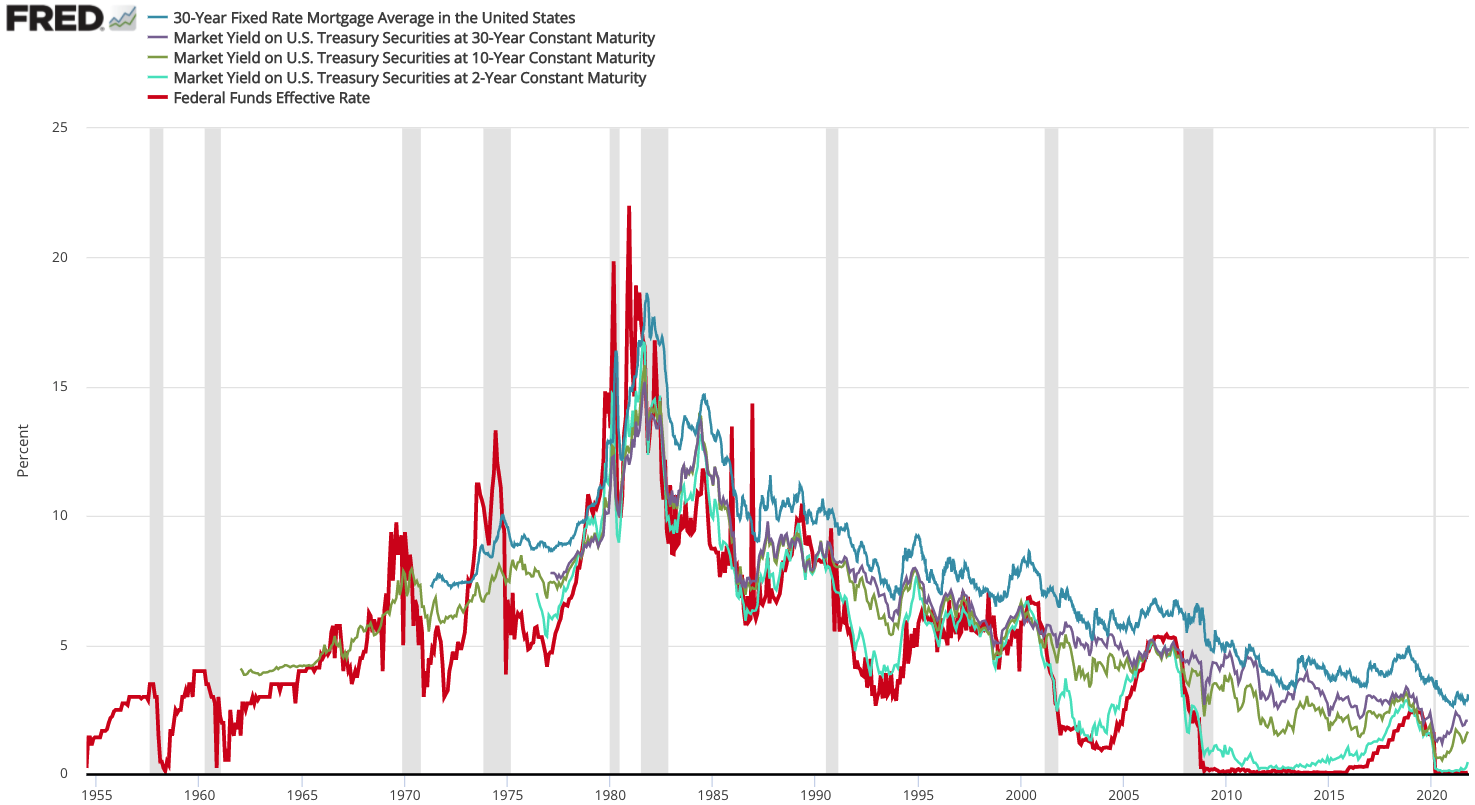

- Opportunities are, interest rates will not stay put at multi-decade lows for a lot longer.

- That indicates you or your survivors will certainly never ever owe greater than what the residence deserves.

- With reverse home loan defaults and repossessions on the rise, many significant banks, including Wells Fargo and also Financial Institution of America, stopped providing reverse mortgages.

- For instance, qualification for Medicaid or Supplemental Security Revenue needs that a single person only have $2,000 in cash available.

A reverse home loan may be a negative idea if leaving a paid-off residence to your heirs is very important to you. The loan equilibrium, consisting of rate of interest, could leave them little to absolutely nothing to inherit from this certain asset. For a government-backed reverse mortgage, the lending limit is equal to the adjusting finance limitation for a solitary family members home in a high-cost location. Funding limitations for government-backed reverse home mortgages do not differ from one county to another. A reverse home mortgage is a finance against the equity in your house. Unlike a standard home loan, there is no sale of the home involved.

Reverse Mortgage Pros And Cons

It's possible to max out your profits with specific sorts of reverse home mortgages. You will not be forced out of the house, however you will quit obtaining cash. Instead of revenue earned, a reverse mortgage is thought about a car loan so the internal revenue service can not get its sticky fingers on it. And also a reverse home mortgage will certainly not impact your Social Safety and security or Medicare repayments.

The Ascent is a Motley Fool solution that ranks and examines crucial products for your daily cash matters. While your home might appreciate in worth and https://www.evernote.com/shard/s601/sh/a271d37b-e473-8e4d-3fb0-2984c1d9f71d/ offset a few of the passion costs and loss of equity, passion quickly accumulates on the quantity you obtain. Only 2 companies use them; both welcome you to seek and pay for independent lawful guidance, to guarantee you are becoming part of the contract easily, and that you understand the agreement as well as all dangers. Whatever the choice, seek personalized recommendations from an economic therapist or debt-management agency. One-third of U.S. houses have actually nothing conserved for retired life as well as the typical quantity saved among the continuing to be two-thirds was $73,200.

Reasons A Reverse Home Loan May Not Help You

Nonetheless, you might still desire to consult various other specialists-- such as your financial advisor or lawyer-- also after completing your called for therapy session. Consumers Union, publisher of Consumer Reports, recommends that property owners store very carefully for a reverse home mortgage and subscribe only when they understand all of its terms and conditions. You ought to think about the effects of each reverse home mortgage payment method before deciding on the method as well as amount of payout. One mistake and you could lose essential federal government advantages you have actually been depending on. If you don't promptly spend a lump sum, for instance, you can easily shed eligibility for needs-based programs readily available to low-income consumers.

How Much Money Can You Get From A Reverse Home Mortgage?

He might have aided her with the procedure yet just mother could make an application for and also receive the loan. If you had months where you can not make a complete repayment or before the 15th of the month, there would certainly be no adverse effects, late costs or credit history, since there is no repayment due to begin with. For anyone thinking about a reverse mortgage, it's a great idea to consult a trusted expert.